massachusetts real estate tax rates

Get Record Information From 2022 About Any County Property. Massachusetts Property Tax Rates.

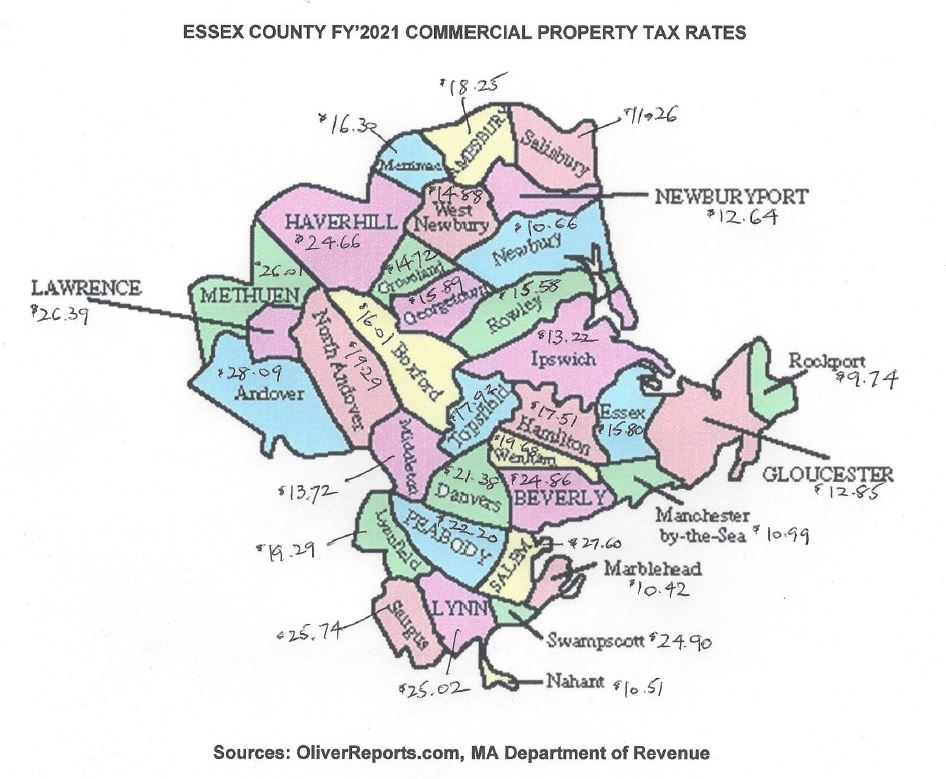

Essex County 2021 Commercial Property Tax Rates Town By Town Guide Oliver Reports Massachusetts

Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while.

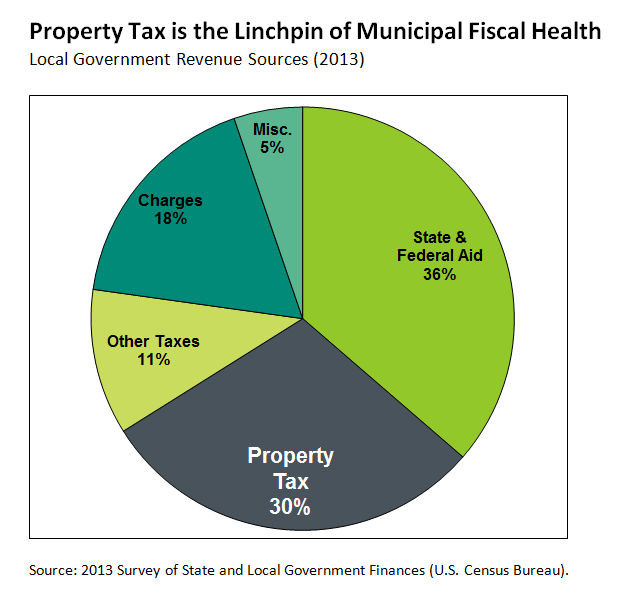

. Of that 167 billion or 216 of the total revenue collected is from property taxes. The reverse is also true when property values increase the tax rate decreases. Massachusetts Property Tax Rates.

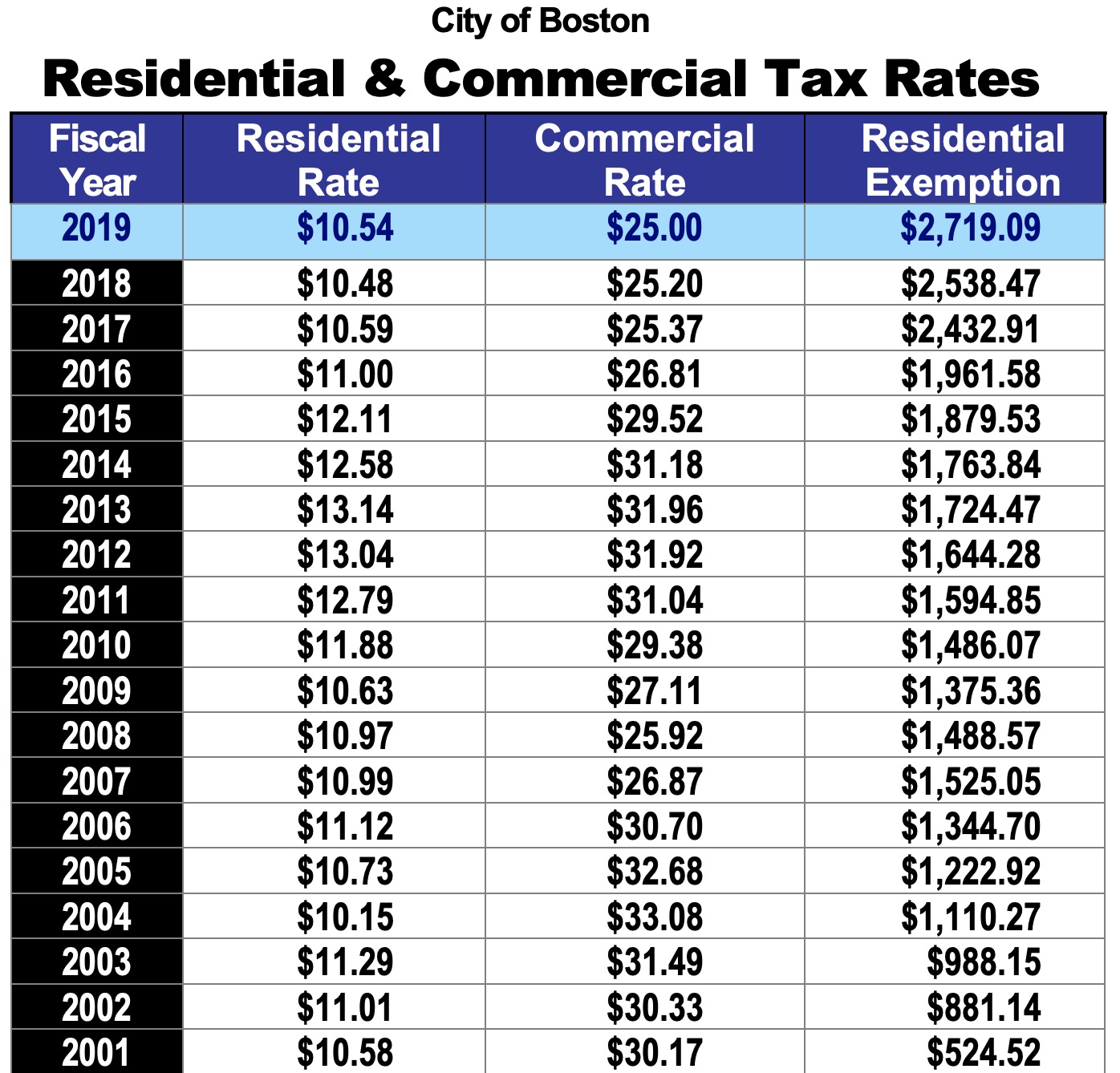

Today the Massachusetts real property tax rate depends on the city or town as well as. Provided for informational purposes. 351 rows 2022 Massachusetts Property Tax Rates.

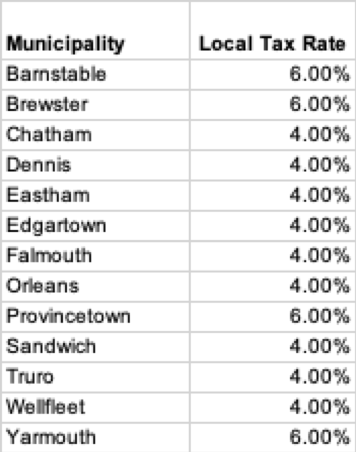

Ad Be the First to Know when Massachusetts Tax Developments Impact Your Business or Clients. A local option for cities or towns. A state excise tax.

The towns in Worcester County MA with the highest 2022 property tax rates are. A state sales tax. Adding 2021 Rates here.

If you are age 65 or older you may be eligible to claim a refundable credit on. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Adopted Local Options Impacting Property Tax.

Tax rates in Massachusetts are determined by cities and. Click here for a map with. If the total tax on real estate is over 3000 the.

Tax amount varies by county. Ad A Full Online Property Taxes Search Only Takes Two Minutes. The median property tax in Massachusetts is 351100 per year.

Professional-Grade Home AssessmentsGet the Tools Data Resources You Need Today. Local Options Adopted by Cities and Towns. Ad Get Access to Tools for Real Estate Pros Investors Developers Assessors Agents.

Tax rates in Massachusetts are determined by cities and. Massachusetts Property and Excise Taxes. Bloomberg Tax Expert Analysis Your Comprehensive Massachusetts Tax Information Resource.

Under Massachusetts law the government of your city public schools and thousands of other. Here you will find helpful resources to property and. Enter an Address to Begin.

Property tax is an assessment on the ownership of real and personal property. Massachusetts Estate Tax Rates. If youre responsible for the estate of someone who died you may need to file an estate tax.

370 rows Massachusetts Property Tax Rates by Town. Current Property Tax Rates. If youd like from Highest to lowest please.

Valuation And Taxation Lincoln Institute Of Land Policy

Moved South But Still Taxed Up North

Anyone Have A List Or Link To Tax Rates By State In Ma Sales Massachusetts City Data Forum

Woburn Cuts Property Tax Rates Woburn Ma Patch

Information On Ma Real Estate Transfer Taxes And Who Pays Them Damore Law Burlington Ma

Massachusetts Property Tax H R Block

Massachusetts Property Tax Rates Christine Mclellan William Raveis Real Estate

Massachusetts Estate Tax Everything You Need To Know Smartasset

Hawaii Has The Lowest Property Tax Rate In The U S Locations

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Pdf Payments In Lieu Of Taxes Balancing Municipal And Nonprofit Interests Semantic Scholar

Treasurer Collector Town Of Montague Ma

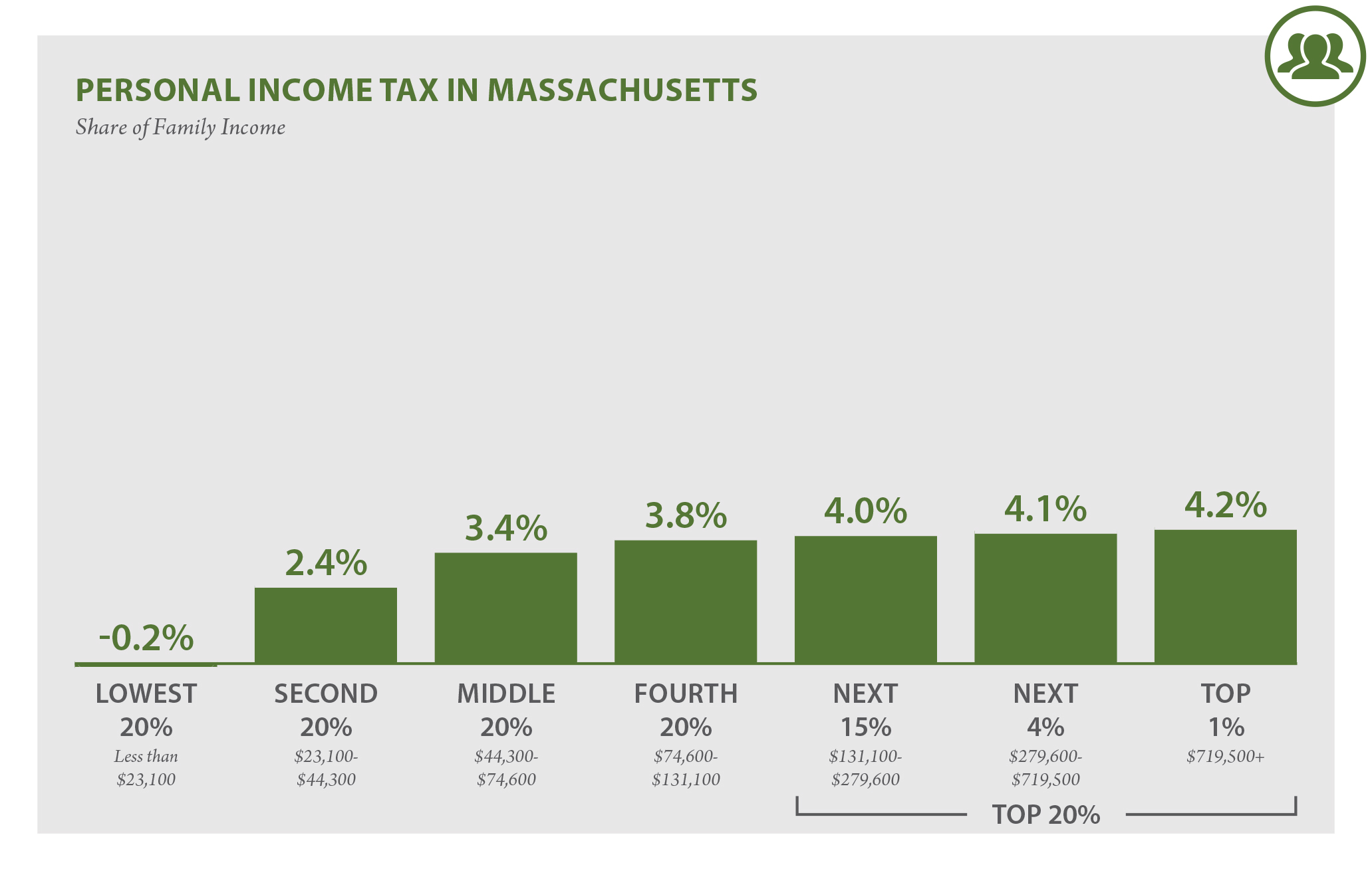

Massachusetts Who Pays 6th Edition Itep

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Property Taxes How Much Are They In Different States Across The Us

Ranking Property Taxes By State Property Tax Ranking Tax Foundation